[ad_1]

Probably the last thing you want to think about when you’ve just filed your taxes is next year’s taxes. Even when your preparation for the past tax year went well, most people want a break from the topic. But as the cliché goes, income tax prep should be a marathon, not a sprint. It’s something you should be thinking about and planning for all year.

Now is the perfect time to start, while this past year’s tax issues are still fresh in your mind. After all, your current financial activities affect your returns next spring. And you want those activities to impact those returns in the best ways possible.

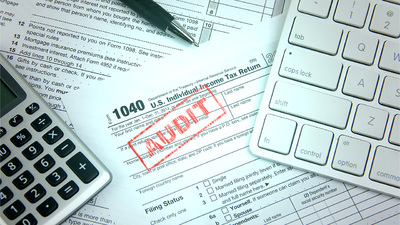

If you haven’t filed your taxes yet, you’d better get on it. As everyone who’s ever done it can tell you, the last-minute tax scramble can be extremely stressful. And, if you make mistakes or cut corners, it might be expensive or at least inconvenient if you find yourself being audited.

If you’re not able to make the April 18, 2023, deadline, you can at least file for an extension. That said, the IRS expects you to pay at least a portion of what you owe when you file for an extension.

Whether you’ve already filed for the 2022 tax year, here are seven ways to keep income taxes in the back of your mind all year, with practical tips that can help make your tax experience next year a little more pleasant.

1. Learn How Life Events Affect Your Taxes

Major events in your life can affect your 2023 taxes, some of them in big ways. For example, if you get married or divorced, have a baby or adopt a child, or have a spouse or dependent die or move away from your home, your filing status and tax benefits eligibility will change.

Similarly, starting a college career, buying a home, or joining the ranks of the unemployed will alter the way you complete your 2023 Form 1040. If you know ahead of time what impact these events have, you might be able to make adjustments in other areas of your financial profile. The IRS has a helpful page about life events(Opens in a new window) that you should consult for more specific guidance.

The Best Tax Software We’ve Tested

2. Decide Now Whether You Should Change Your Withholdings or Pay Estimated Taxes

If you’re a W-2 employee, consider the outcome of your 2022 taxes. Did you get a large refund? Or did you have to pay a significant amount? If either is the case, you should think about changing your withholding, especially if you’ve experienced or will experience one or more of the life events listed above. The IRS Tax Withholding Estimator(Opens in a new window) may be helpful here. You’ll have to fill out a new form W-4(Opens in a new window) to change your withholding status.

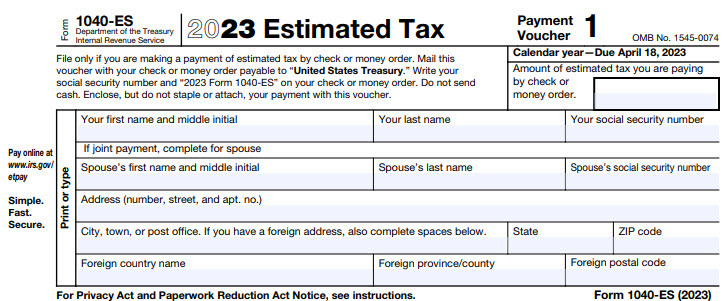

If you are or will be self-employed for the first time in 2023, you’ll need to estimate how much you will owe in taxes every quarter based on your income and expenses for each period and send that amount to the IRS and state tax agencies. It’s not easy, and the amount may be nothing more than an educated guess. If you don’t pay in advance and wait until taxes are due next spring, you’ll have to pay an entire year’s worth of taxes at once, plus penalties and interest.

QuickBooks Self-Employed can help. It allows you to import and categorize your banking transactions. Based on that information, QuickBooks estimates what you might owe every quarter.

The IRS has information about paying estimated taxes(Opens in a new window). Having some insight on where you stand with income taxes throughout the year helps with your ongoing tax planning.

(Credit: IRS)

3. Keep Accurate Records

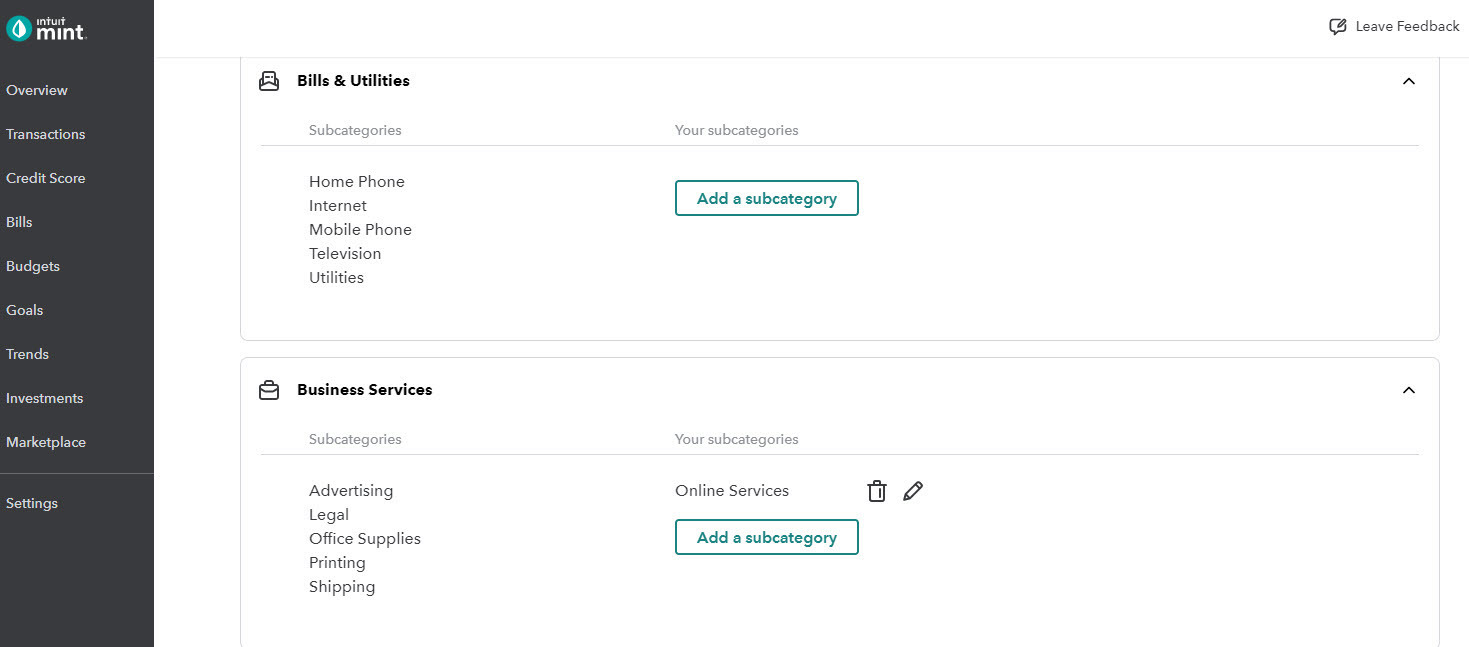

Keeping accurate records is especially important if you’re self-employed. You need to maintain thorough, accessible records of all your business-related income and ensure you report all the money that comes in. You must document every expense and figure out the correct tax-related category for each one. If you do this on paper, save every receipt in folders organized by month or category and make a note about its purpose.

Personal finance apps and small business accounting software can help tremendously with keeping financial records. With many apps, you can import all your banking transactions and the app or website helps you categorize them. These apps help with other bookkeeping tasks, such as budgeting and creating reports at tax time, too. Very small businesses might be able to get by with Mint (free) or Quicken. Larger or more complex businesses might consider Intuit QuickBooks Online or Zoho Books.

If you’re an employee who receives a W-2, you should still have digital or physical folders for storing documents such as charitable contribution records and property tax statements. When you start to receive forms like your W-2 and 1099s next year, you can add them to the mix.

(Credit: Intuit Mint)

4. Learn More About Tax Deductions and Credits

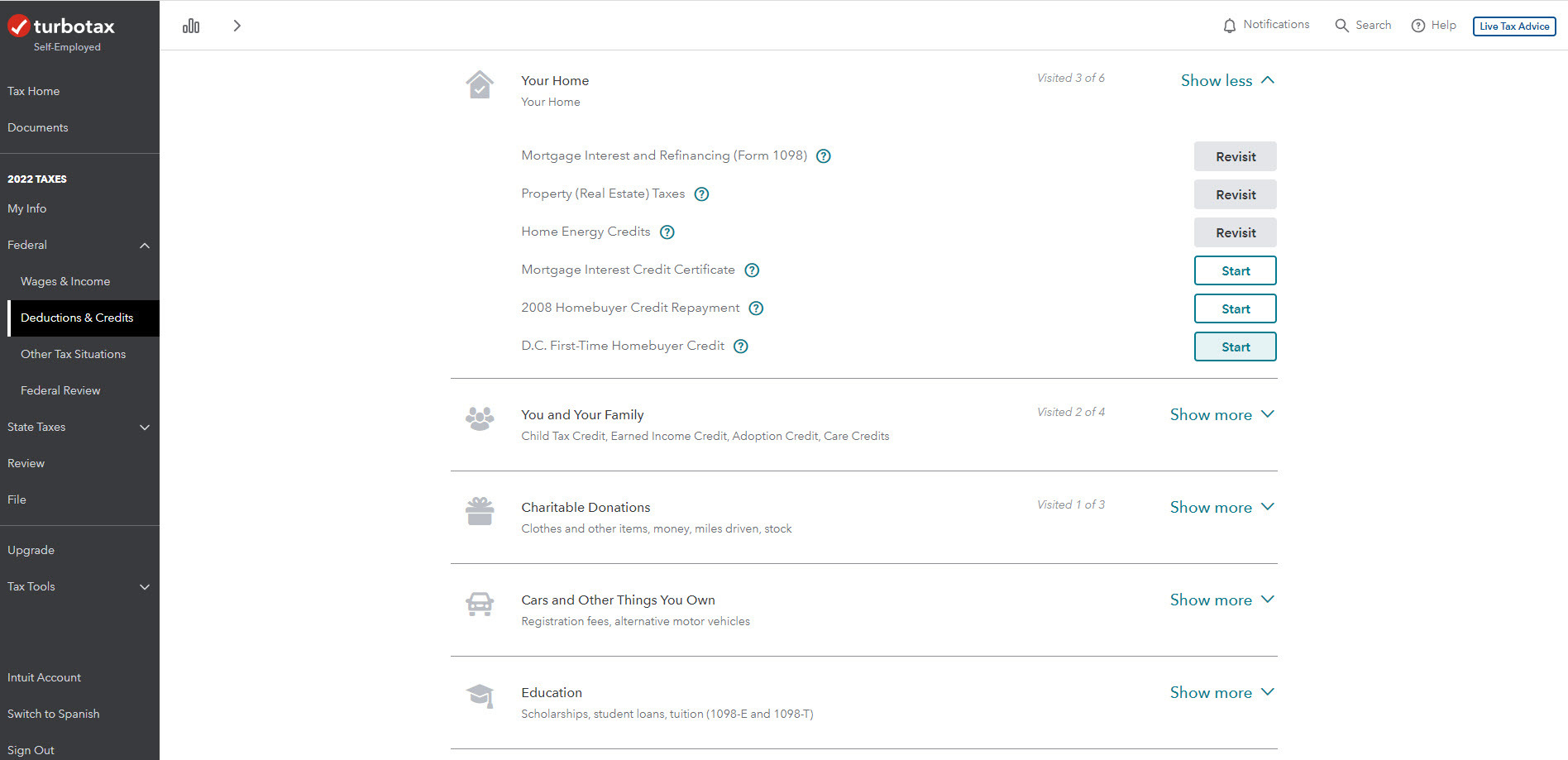

The IRS form 1040 and its supporting forms and schedules contain hundreds of deductions and credits that can save you a lot of money in tax breaks. (Interpret them correctly, and you might be able to take some awfully strange tax deductions.) If you do your taxes without software, it’s easy to miss some of these tax breaks, even if you’re eligible. The trick is to be aware of them, so you know when an expense might be deductible as you go through the year.

(Credit: TurboTax)

The IRS has two web pages that list all the major deductions and some lesser-known ones, with links to detailed information: one is for individuals(Opens in a new window) and the other is for businesses(Opens in a new window).

NerdWallet has a list of popular credits and deductions for 2023(Opens in a new window). You can track your financial accounts here and get your credit score periodically for free.

Keep an eye on personal tax preparation websites and the year-round services they offer, too. Some maintain blogs that cover specific deductions and credits for 2022 and keep you up to date on tax law changes throughout the year. TurboTax and H&R Block offer extended services for individuals who use the sites’ tax preparation tools. Both assign you to a CPA or other tax professional who can answer your questions and troubleshoot your return via video chat. They’re available year-round to help with tax planning.

Recommended by Our Editors

5. Save for Retirement During the Year

If you don’t already have an IRA or a 401(k), it’s time to consider investing in your future and making a dent in your tax obligation at the same time. If you do have one and aren’t contributing the maximum amounts, think about bumping up the total you put in.

Self-employed individuals may not have the employer-matching option that W-2 employees do, but they can still put money away for retirement and claim these contributions on their tax returns. Options include a Simplified Employee Pension (SEP) or a one-participant (solo) 401(k) plan. Another is the Savings Incentive Match Plan for Employees, also known as the Simple IRA Plan. The IRS has more detailed information about all these retirement plans for the self-employed(Opens in a new window).

6. Give Away Some Money

You don’t have to wait until December 31 to think about philanthropy. Donating money to qualified charitable organizations throughout the year usually translates to a tax deduction. In fact, when filing for the 2022 tax year, non-itemizers are allowed to deduct up to $300 in charitable contributions ($600 for married filing jointly). As of this writing, we don’t know what Congress may do with this deduction for 2023, so keep an eye on tax-related news.

You won’t get a deduction for giving someone a gift of cash or property worth up to $17,000 during the year, but neither will you have to pay the IRS gift tax. If the gift is worth more than that amount, you will have to pay the gift tax, something to keep in mind as you dole out cash or property as gifts.

(Credit: H&R Block)

7. Review Your Tax-Related Income and Expenses

If you’re self-employed and have to pay quarterly taxes, you have to review your tax-related income and expenses anyway. You should be looking at them at least monthly. If you use a personal finance or small business accounting application, it shouldn’t be a problem. You can even get a rough idea of the balance between incoming and outgoing money by using a paper system and a calculator or Excel.

Keep a copy of your 2021 and 2022 tax returns handy. Even though tax law changes for 2023 won’t be finalized until the end of the year, you can see why you got the refund you did or had to pay in as much as you did over the last couple of years. These returns are also useful for figuring out your total tax obligation over the past few years. Unless your financial situation or the tax code has changed drastically, you can expect a similar tax obligation.

Keep Track of Your Taxes All Year

Pay attention to news about tax law changes for the 2023 tax year as they’re announced. They may affect your financial decisions this year. For example, the IRS has already announced annual inflation adjustments(Opens in a new window) for more than 60 tax provisions. Also, if you receive payment through a third-party network like PayPal, Square, or Cash App for goods or services you’ve supplied, you (and the IRS) will receive a 1099-K if your transactions total more than $600. The threshold used to be $20,000. This change was planned for the 2022 tax year but was delayed.

Tax planning should be a natural part of your overall financial planning—and it should go on for all 12 months of the year. If you treat it that way, you’ll find that preparation and filing season won’t be nearly as painful and panicked. When it comes time to file, tax software can help you get a bigger refund and reduce your risk of an audit.

[ad_2]

Source link : https://www.pcmag.com/how-to/7-ways-to-minimize-your-taxes